Using Data to Take the Guesswork out of Your Shipping Strategy

Many business decisions are made via rules of thumb and gut feelings. However, in many cases that doesn’t have to be the case. The data needed to make accurate decisions is there, you just need to take advantage of it. This is especially true if you’re working in ecommerce, where everything can be tracked, measured and analyzed.

If you’re interesting in how you can take the guesswork out of your shipping descisions with data, we invite you to watch this presentation by Jake Stein from Stitch Data from the Shippo Summit. If you prefer, we’ve also transcribed his presentation below.

I’m co-founder and CEO of Stitch. Stitch helps out with warehouses, but not the kind of warehouses that most people are talking about here. In our context, a data warehouse is basically a fancy database, that has lots of different data from lots of different data sources. So things like your shipping data, your transactional data, payment processing, customer support, what you spend on ads, all the different data sources you have. And our goal with Stitch is to enable the next generation of analytics companies, so folks who are doing things that are very different, all different sorts of analytical use cases, they need data from all the different applications that businesses use, consolidated into one spot, so that they can analyze it, so they can inform decision making. So, that’s what we do.

When they survey customers, three out of four say that they’ve added an extra item or two to their cart, to qualify for free shipping. I know that that’s true for me, I actually have a list of things that I need that aren’t time-sensitive, and I just add it to carts when I want to get that free shipping.

I want to start off by saying, probably not a contentious statement for all of you here, but shipping matters. And in particular, free shipping. And a lot of this touches on similar themes to what Mike was saying, and I thought that talk was great. 60% of ecommerce companies cite free shipping with conditions, as their most successful marketing tool. And I think that’s so funny, with conditions. It seems like a withholding friendship or something like that. When they survey customers, three out of four say that they’ve added an extra item or two to their cart, to qualify for free shipping. I know that that’s true for me, I actually have a list of things that I need that aren’t time-sensitive, and I just add it to carts when I want to get that free shipping.

Importance of your best customers

Your best customers care about shipping. And they care about, specifically, free shipping. And your best customers, they matter a lot. This is a benchmark report we did at RJMetrics, across about 400 different ecommerce companies.

- The top 1% of customers account for almost 20% of revenue

- The top 5% account for more than a third

- The top 10% account for almost a half

So if you upset a small percentage of your customers, that’s potentially a very costly thing. And similarly, if you acquire more of those customers, or if you convert some of your existing customers into folks like that, it’s incredibly valuable. Because the best customers, if you compare the top 1% to the median, they spend 5 times more per order, and their lifetime value is over 30 times as much. So thinking about shipping is kind of both a input and an output to that calculation, because you can use free shipping to get people over that threshold, to get them to buy more and commit more to your brand. And then, as they’re spending more, they can take advantage of whatever shipping offers you have.

Free Shipping Thresholds

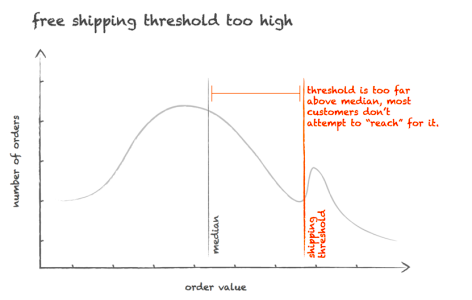

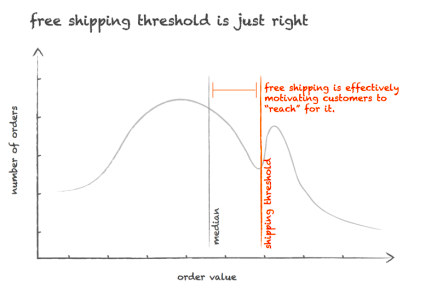

If you think about free shipping thresholds, where to set them, why set them in different places, you can imagine a distribution of orders. And you have people that are spending a little, you have people that are spending a whole lot, and as you can imagine, most people fall somewhere in-between. And if you think about the median order, what you want your free shipping threshold to do, is to kind of incentivize people to reach. They put some stuff in their cart that they came to you already looking for, and then they think, “You know what? I don’t wanna pay shipping, I’m gonna buy that one more item”. So depending on where you set that threshold, it can have a huge impact on whether or not people are reaching for that order. And if you set it too low, no one’s gonna be reaching, everyone’s gonna get free shipping, and it’s gonna cost you lot of money.

And free shipping is actually really emotional, this is not something you can do purely based on data, as much as it hurts me to say that as a data guy. Amazon has moved their free shipping threshold from $25 to $35 to $49, back to $35, this is all for non-prime. And they get eviscerated every time it gets raised, if you look at Amazon forums, people are just calling them horrible people. And every time they lower it they’re heroes, it’s fantastic, and everyone is super excited about Amazon.

Amazon spends a lot of money on this, this chart blows my mind. 2015 was $5 billion on shipping, 2016 it’s $7.2 billion. This is a lot of money and, obviously, Amazon is the gorilla in the room that we all need to think about, and change our strategy based on that. But that is not cheap, and they’re making huge investments, so you have to be smart about how you’re going to do that to be strategic. Because I don’t know the balance sheets of everybody in the room, but I bet they’re probably smaller than Amazon, for at least most of you. And if not, good job.

So, think about the other side of that slide I showed before about free shipping thresholds. It can’t be too low because then everyone gets it, no one’s reaching for additional products for their cart. And you don’t want it to be too high, because let’s say my cart is filled with $20 worth of stuff, and the free shipping threshold is $60. I’m probably not gonna triple my order value, just to get that free shipping. So if you set it too far away, you’re not gonna get people just to reach, it needs to be attainable but still a little bit of a stretch. Because if it’s too much of a stretch, then you’ll get abandoned carts.

And this just stinks. It’s one of the top three causes of shopping cart abandonment, and depending on who you ask and who does the study, shopping carts get abandoned 60% to 80% of the time. Which is just insane, like, you’ve gone, you’ve bought ads on Google or Facebook, you’ve gotten them to your website, you’ve split tested all different layouts, you’ve got them to convert, you went to different product pages, they looked at reviews, they rated it, they compared different variants, they added it to their cart, they get to checkout, and then they leave. And almost everybody leaves, 80% of people leave. That’s so many people. So anything you can do to take a bite out of that is huge, and just makes an enormous difference, and free shipping has that possibility. So the Goldilocks zone, where you want to be, is it’s not too high, and it’s not too low, and it’s just right. You want it to be higher than the median, but no so much higher than the median that it’s unattainable, because then you get people just to scoot out there.

Threshold Strategies

So how do you figure out what that right threshold is? It’s very easy for me to make charts like this and say “Yeah it’s squiggly like that, and you want to be over there, and not over there” but that’s not really tangible, useful and for you to set free shipping thresholds. So there’s a couple of different strategies you can use. One thing that’s almost always useful is to bucket your orders into different amounts. You can have a continuous distribution of what the different orders look like, but you can set reasonable buckets. You know, $0 to $20, $20 to $40, $40 to $80. These buckets may make sense depending on your business, or something different. And what you want to do is compare the median to where your free shipping threshold is, and try to just get a sense visually of where you can go. Because, like I said, this is partially based on data, and partially informed on your customer’s emotions, and how much you think that there’s something else that they kinda sorta want, but maybe it’s not justified to buy right now.

You can also just test different thresholds, you can do it serially. Let’s say today it’s $35, like Amazon was changing that around, you can bet they did tremendous amount of analysis of how the before and after impacted their average order value. You can also run limited time promotions, you can say “For this month only, for the holiday season, for Mother’s Day or Father’s Day, you get free shipping if you, you know, put something on this order. We’re lowering the threshold.” The gold standard though, is an A/B test. That’s the only way you can really know for sure, or at least that’s the highest confidence you can get. As if you’re just randomly assigning your users to different buckets, giving some of them one threshold, some of them the other threshold and then analyzing their behavior and see how it’s different.

But all those different strategies I mentioned, they have some real downsides, in terms of how to actually figure that out. If you do that buckets and you, you know, create the plot, it’s just gonna give you a gut answer. It’s gonna give you something to say “Like okay, it’s probably too light, it’s more something that informs future experimentation.” If you serially test different thresholds, you have one thing this month, another thing three months from now. You’re gonna be impacted by seasonality. If one of those things is during the holiday season, depending on your business, that may be much bigger. It’s also you’re acquiring different customers, your ad mix is different, so it’s not gonna be a perfect test.

If you run limited time promotions, that’s also not perfect. Because if you have something where you’re adding urgency, and you’re not gonna have that urgency later, well then obviously, people act differently under situations of urgency and under situations where they don’t have it. So coupon codes, all those things, they can really impact it.

A/B test is the best from a data perspective, but you might piss some people off. If I found out that I spent $50 and I ordered the exact same things as somebody else, and they got free shipping and I didn’t, I am not gonna feel great about that. And depending on what business you’re in, that may be worth it. And, you know again, this is the best way to know for sure, but depending on your emotional relationship with your customers, you have to know what it’s gonna be like if they find out. Because, odds are, someone is probably gonna find out, and then they’re gonna be the most vocal person on your forums. So again, it’s something you could be okay with or something that you might not be.

Many KPIs

Everything I’ve been saying so far, is based on revenue. And that’s a simplification, because you have a lot of different KPIs in your business that matter, you have different cost of goods sold for different items. They have different weight, they costs different amounts to ship. Some things are fragile, some things need to be refrigerated. Again, this is all very situational specific. The KPI that you’re going for is gonna be based on what’s important to your business right now. So if you’re a public company, you’re probably optimizing for profitability. If you’re a venture-backed startup, you might be trying to raise your next round of funding and you’re optimizing for GMV revenue. And if you have some other big strategic goal, like expand internationally, maybe it’s fine to lose a bunch of money on international shipping, in order to gain market share.

And because domestic versus international can be, just complete apples and oranges in this case, there’s different local customs, there’s different costs, there’s different timing. We work with some businesses that ship only to cities in China, and some businesses that ship only to rural areas in China. And the amount of differences between what it costs to ship, the timing expectations, whether people have addresses, just stuff like that, is just unbelievable. And so, lumping all that together to do the analysis, is not really useful, so you need to separate it out.

And then again, like I mentioned before, you need to filter out the things that are gonna skew the data. So promotions, coupon codes, limited time offers, holiday versus not holiday, if you have membership program that get a discount. You want to separate all those buckets, and again, this is a lot more work but this is how you get the real insight into it.

Shipping for Growing your Business

One other way to use the shipping info for improving your business, is for prospecting. So I was talking a lot about once you have the customer on your website, how do you get the most value out of them. But this is actually from a case study we did back in RJMetrics, where we had a company that was both ecommerce and catalog. And they didn’t have gifting functionality on their website, but they wanted to combine their payment data with their shipping data to identify who was actually gifting orders. And you needed both those data sets, and once you got them together it wasn’t brain surgery, just, you know, look at the ship to, look at the bill to. If they’re different or at least sufficiently different, there’s a good chance it’s gifting order.

Most of their catalog acquisition was just list buying. They did, demographic comparisons, they went to a vendor, bought a list, shipped catalogs to those. What they tried next was, they identified all the likely gift recipients and did a targeted catalog mailing to those gift recipients, and the conversion rate was just off the charts. Because these are people that have a really strong, positive emotion. Somebody they love sent them a gift, from this merchant, and then they got a follow up like “Hey, wouldn’t you like to give this to somebody else?” So that kind of person, compared to somebody who’s, you know, the right age and gender, it’s really just off the charts in terms of things like this. So this is not a tough analysis to do, you just need all your data together to do that analysis.

Tools for Ecommerce Data Analysis

So how do you actually analyze your data? There’s literally no reason to be a customer of ours if you’re only buying our tool by itself, because it’s useless. We’re something that takes data from a bunch of different places, puts it in another spot and then something else sits on top of it in analyzing it. So we’re pulling data from Shippo, and Shopify, and Stripe and all those different places, loading into a data warehouse, something like Amazon Redshift or Google BigQuery, or just a regular database like Postgres. And then there’s a visualization tool that sits on top of it, you’ve probably heard of things like Tableau, or Looker, or Mode Analytics, or Chartio. These are all different tools that people use to visualize the data, once they have it all in one spot.

And I actually started talking to our partners when I signed up to do this talk, and say like “Hey, what should shippers do with their data? You know, once they get it in their data warehouse, what sorts of analysis they can do?” And several of our partners helped us out and basically said “Hey, we can create some of these template analyzes”. So we got data from Shippo and Shopify, but it would work with any commerce platform, put it all together and created some template analyzes that, again, if you follow up with me afterwords, I can set you up with them and they can give you some of these analyzes.

Chartio

The first one is Chartio. This is a tool that’s great for business users, very easy to get up and running. They created lots of different reports around geographic location, shipping trends over time and, again, super easy tool to get up and running with.

Mode Analytics

The next one is Mode Analytics. This is more of a tool for power analysts, so if you love writing SQL and Python, this is the tool for you. Lots of different flexibility in terms of how to structure the analysis on shipping trends over time, price per carrier, things of that nature.

Looker

The next one is Looker. This is a tool that focuses a lot on data modeling. So they have their own proprietary language called LookML, that sits on top of the data warehouse, that cleans up all the data and puts it in a more useful format. And then have a visualization interface on top of that, for you to analyze. So they present, a kind of a view of what does an operations person need to see. If you’re working in a warehouse or you’re an operations manager, here’s a dashboard that you can use to actually make some actual data, then get it done.

Data Build Tool

The last one here is for any of you that are much more tech-focused, this is an open-source tool called DBT. It stands for Data Build Tool, and it’s basically for doing that kind of data modeling, but right inside the database and define it all via SQL. So this is completely free to use, it’s managed by a consultant shop that we worked with called Fishtown Analytics. And they built a model for Shippo, so that if you pull your Shippo data out of the API and load it in your data warehouse, you can actually save a bunch of time and just start analyzing it with a fresh start. And this is on GitHub.

So how do you get your shipping data? This is something that we can help out with but there are some other options too. So we have a Shippo integration, that’s the partnership we launched about two months ago, you can just set up on our website and use it. There’s about 60 other data sources we pull from, most of which are relevant to ecommerce. And then we also launched this open-source project where, let’s say you have a data team that likes to do things internally, and you don’t want to use an external vendor for it, you want to own it. Well we actually open-sourced about a quarter of our integrations, including Shippo, and we’re gonna be open-sourcing the rest of them over time so that you can just grab the code, run it on your own system, pull it on your own schedule.

Transcript has been modified for clarity.

Speaker Bio: Jake Stein is the co-founder and CEO of Stitch. Previously, he was co-founder of RJMetrics, an ecommerce analytics software company, which was acquired by Magento in July 2016.

This video comes from our inaugural shipping conference: Shippo Summit. Hundreds of customers, partners and industry experts from around the world joined us in San Francisco for a full day program of inspirational talks and dynamic conversations that explored leveraging shipping as a competitive advantage for ecommerce businesses.

Shippo is a multi-carrier API and web app that helps retailers, marketplaces and platforms connect to a global network of carriers. Businesses use Shippo to get real-time rates, print labels, automate international paperwork, track packages and facilitate returns. Shippo provides the tools to help businesses succeed through shipping.